234000.site Gainers & Losers

Gainers & Losers

Using Home Equity For Business Loan

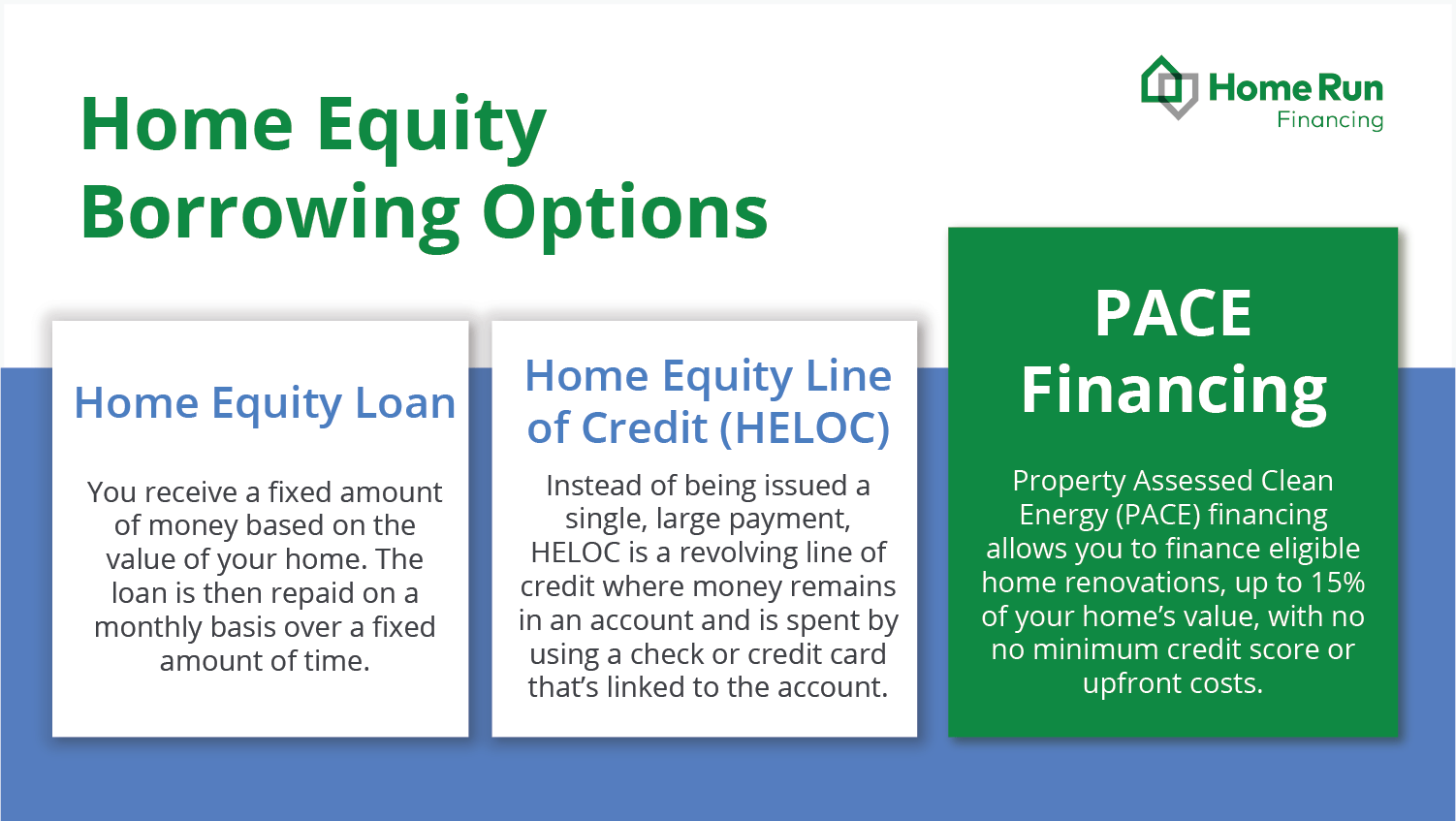

Figure offers a fast and easy way to turn your home equity into cash, up to $k. Using a HELOC for your business could offer a lower interest rate than with a. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is. When you use a part of it for a business loan, you can do so again and again, giving you the financial freedom to build steady growth and maintain your access. By using your home as collateral for your loan, you're able to borrow money at a fixed rate that's lower than most other types of loans. Apply for a Home Equity. A Home Equity Loan provides flexibility for you to use the equity that you have built into your home to use for other purposes. Learn more about our Home. Have High Debt? If you've accumulated debt – whether it's from your mortgage, student loans, credit cards, or from a medical procedure – a Home Equity Line. HELOCs can be quite effective if you have considerable equity in your home, particularly if you have more equity in your home than you need to borrow for your. Figure offers a fast and easy way to turn your home equity into cash, up to $k. Using a HELOC for your business could offer a lower interest rate than with a. Home equity loans typically come with lower interest rates compared to some other forms of financing. This is because your property serves as collateral and. Figure offers a fast and easy way to turn your home equity into cash, up to $k. Using a HELOC for your business could offer a lower interest rate than with a. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is. When you use a part of it for a business loan, you can do so again and again, giving you the financial freedom to build steady growth and maintain your access. By using your home as collateral for your loan, you're able to borrow money at a fixed rate that's lower than most other types of loans. Apply for a Home Equity. A Home Equity Loan provides flexibility for you to use the equity that you have built into your home to use for other purposes. Learn more about our Home. Have High Debt? If you've accumulated debt – whether it's from your mortgage, student loans, credit cards, or from a medical procedure – a Home Equity Line. HELOCs can be quite effective if you have considerable equity in your home, particularly if you have more equity in your home than you need to borrow for your. Figure offers a fast and easy way to turn your home equity into cash, up to $k. Using a HELOC for your business could offer a lower interest rate than with a. Home equity loans typically come with lower interest rates compared to some other forms of financing. This is because your property serves as collateral and.

Your home has a hidden superpower: it can turn your dreams into reality! Tap into your home's equity with a HELOC to provide funding for what matters most. Home Equity Line of Credit · A line of credit that provides a smart source of cash · Borrow up to 70% of your combined loan to value · No points, closing costs or. Now your home's market value is a good bit higher than what you owe on your loan. That means you have equity. And you can use it as collateral to obtain a low-. A home equity loan is a good choice if you need money for a one-time expense. The maximum amount you can borrow depends on the appraised value of your home and. However, accessing home equity through a home equity loan (HEL) or home equity line of credit (HELOC) requires you to use your home as collateral. Another, non-. It's an open-ended loan that gives you the flexibility to borrow again and again without having to reapply. Plus, you only make payments on the amount you use. Can I get a business loan against my house? Yes you can. This is called a homeowner business loan. It is a type of secured loan that offers business owners the. Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home. MBA's Home Equity Lending Study includes benchmarking data - volume, utilization rates, operational metrics, and growth expectations - related to lending. Home Equity Loans: Funds With Flexible Loan Terms and Rates A Home Equity Loan is a great way to pay for a planned expense using the equity in your. Home equity loans are pretty straightforward: You borrow money against the amount of equity you have in your home. Equity is the difference between the market. If you're using your home as security and are putting money into an existing business then we may be able to finance up to % of the value of your property as. These loans are typically offered by banks, but can be offered by private lenders. Commercial equity financing is also ideal for business owners that need. Let your home lend you what you need. By using your equity as collateral, you can lock in competitive financing. · Competitive, variable rates for ongoing needs. Similar to a credit card, a home equity line of credit (HELOC) is a revolving loan that allows you to borrow funds using the equity in your home as. Home equity loan. Sometimes referred to as a second mortgage, this fixed-rate loan is secured by your home and paid back in monthly installments over time. Home Equity Line of Credit (HELOC) – You control when and how to access the money, what it's used for and how much of the line of credit to use. · Fixed-rate. A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large. Like a HELOC, you borrow against your home's equity and use your home as collateral. Unlike a HELOC, a home equity loan provides you with a lump sum of money. It's convenient. · The interest on a home equity line or loan may be tax deductible. Contact a tax advisor regarding the deductibility of interest. · There are no.

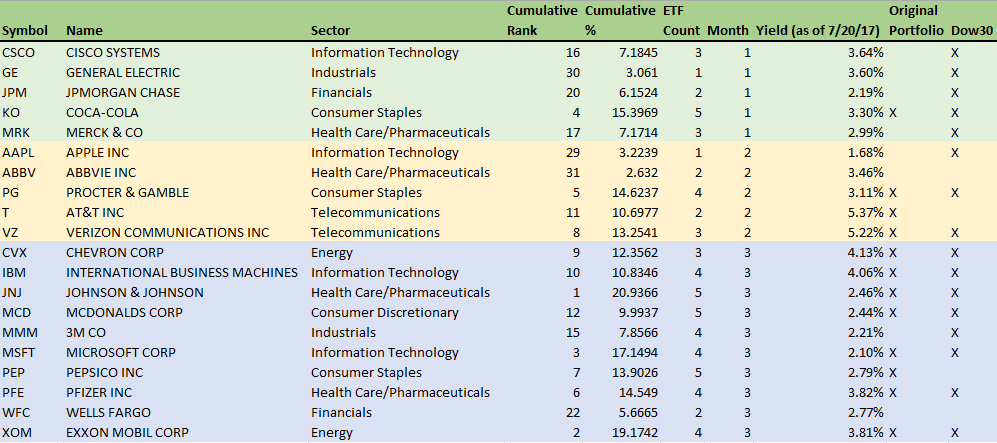

Dividend Stocks By Month

Monthly dividends provide investors with regular income, offering more frequent payouts than quarterly dividends. However, they can increase administrative. Monthly Dividend Stocks UK ; SMIF, TwentyFour Select Monthly Income Fund, FTSE SmallCap ; SDIV, Global X SuperDividend UCITS ETF, ETF ; JEGP, JPM Global Equity. 7 Best Monthly Dividend Stocks to Buy Today · NASDAQ:GLAD · NYSE:DX · NASDAQ:HRZN · NYSE:O · NYSE:LTC · NYSE:PFLT · NYSE:SLG. Dividends Declared, Dividends Declared By Indian Companies, List Of Companies Dividends Declared - 234000.site We're going to look at 9 of the best monthly dividend stocks to buy. You'll see some similarities across the selections. A dividend calendar showing the current dividend yield · A dividend calendar covering the best dividend stocks worldwide · Passive Income with Dividends · Monthly. This list includes all the stocks that pay dividends every month and are listed on the NASDAQ, NYSE or NYSE American in the US. S&P Dividend Yield is at %, compared to % last month and % last year. This is lower than the long term average of %. Stocks pay dividends monthly, quarterly, semi-annually and annually, giving investors plenty of opportunity to earn predictable income. Receiving steady. Monthly dividends provide investors with regular income, offering more frequent payouts than quarterly dividends. However, they can increase administrative. Monthly Dividend Stocks UK ; SMIF, TwentyFour Select Monthly Income Fund, FTSE SmallCap ; SDIV, Global X SuperDividend UCITS ETF, ETF ; JEGP, JPM Global Equity. 7 Best Monthly Dividend Stocks to Buy Today · NASDAQ:GLAD · NYSE:DX · NASDAQ:HRZN · NYSE:O · NYSE:LTC · NYSE:PFLT · NYSE:SLG. Dividends Declared, Dividends Declared By Indian Companies, List Of Companies Dividends Declared - 234000.site We're going to look at 9 of the best monthly dividend stocks to buy. You'll see some similarities across the selections. A dividend calendar showing the current dividend yield · A dividend calendar covering the best dividend stocks worldwide · Passive Income with Dividends · Monthly. This list includes all the stocks that pay dividends every month and are listed on the NASDAQ, NYSE or NYSE American in the US. S&P Dividend Yield is at %, compared to % last month and % last year. This is lower than the long term average of %. Stocks pay dividends monthly, quarterly, semi-annually and annually, giving investors plenty of opportunity to earn predictable income. Receiving steady.

Contains Publix stock prices and dividend information over the last five years, in an interactive chart. Looking for monthly dividends? Here are the 5 highest yielding monthly-paying stocks, Closed-End Funds and ETFs. While dividends could be paid annually. Our research team runs the industry's toughest monthly dividend screening test and only picks from the top 5%. This list includes all the stocks that pay dividends every month and are listed on the NASDAQ, NYSE or NYSE American in the US. Find dividend paying stocks and pay dates with the latest information from Nasdaq. Realty Income is an S&P company with the mission to invest in people and places to deliver dependable monthly dividends that increase over time. Learn how to find stocks that pay monthly dividends to earn returns on your investment. Discover a list of monthly dividend stocks and ETFs from around the. The biggest monthly dividend stock is Itau Unibanco Holding (ITUB) with a market cap of $B, followed by Realty Income (O) and Banco Bradesco (BBD). Last. Right. This depends on the amount invested and the yield paid. I've recently picked some fundamentally good dividend stocks. Find the best and high dividend stocks with upcoming dividend payouts and ex-dividend dates, along with dividend yield, to discover declared and estimated. Looking for monthly dividends? Here are the 5 highest yielding monthly-paying stocks, Closed-End Funds and ETFs. While dividends could be paid annually. Dividend stocks can be a great source of income, but most companies issue them only four times a year. These seven names make their payouts once a month. Monthly dividend stocks can be the perfect investment for those who need regular income. Learn about the best monthly dividend stocks and why they stand. Stocks · Crypto · Fixed Income, Bonds & CDs · ETFs · Options · Markets & Sectors 12 Month Low-High. 07/31/$ - $ Hypothetical Growth of $10, Provided an attractive month rolling dividend yield of % and day SEC yield of %. Yield ranked in the top half of the Derivative Income category ETFs that pay dividends monthly ; VGLT · D · B USD, USD ; IGIB · D · B USD, USD ; DGRW · D · B USD, USD ; VCLT · D · B USD. The Monthly Dividend Company®. WHO WE ARE. Purpose & Values · Business Model Stock Information; Dividend Payment Information. Dividend Calculator. Monthly dividend stocks are securities that pay a dividend every To meet my goal of earning $50/month in dividends I bought following stocks. Stocks pay dividends monthly, quarterly, semi-annually and annually, giving investors plenty of opportunity to earn predictable income. Receiving steady. Monthly data from 01/01/ through 9/01/ Calculations assume a starting portfolio value of $1, Indexes are unmanaged, do not incur management fees.

Being In Debt

If you know you're not going to be able to keep up with your loan payments, you might be better off selling the car yourself and paying off the debt. You'll. being wasted on paying interest. Whether you've held debt in the past or not, it is within your power to keep it out of your life going forward. Here are. Debt is something, usually money, owed by one party to another. Debt is used by many individuals and companies to make large purchases they could not afford. If you know how and can use money effectively, having the right kinds of debt is usually much better than having no money. Debt is money owed to a person or entity that must be paid off by a deadline. Mortgage loans, student loans, car loans, and credit card balances are types of. Credit card debt can be compounded by finance charges, a raised interest rate and other fees if payments are missed or late. Problems with a credit card can. Additionally, our society values freedom and autonomy, and being indebted creates feelings of shame, constraint, and reliance on others. For some, that “inner. As a general rule, don't borrow more money than you can handle. Borrowing money is a lot easier than paying it back. Smart borrowing can be convenient and. In this article, we'll examine how debt affects us emotionally, influencing how we behave and how it makes us feel about ourselves. If you know you're not going to be able to keep up with your loan payments, you might be better off selling the car yourself and paying off the debt. You'll. being wasted on paying interest. Whether you've held debt in the past or not, it is within your power to keep it out of your life going forward. Here are. Debt is something, usually money, owed by one party to another. Debt is used by many individuals and companies to make large purchases they could not afford. If you know how and can use money effectively, having the right kinds of debt is usually much better than having no money. Debt is money owed to a person or entity that must be paid off by a deadline. Mortgage loans, student loans, car loans, and credit card balances are types of. Credit card debt can be compounded by finance charges, a raised interest rate and other fees if payments are missed or late. Problems with a credit card can. Additionally, our society values freedom and autonomy, and being indebted creates feelings of shame, constraint, and reliance on others. For some, that “inner. As a general rule, don't borrow more money than you can handle. Borrowing money is a lot easier than paying it back. Smart borrowing can be convenient and. In this article, we'll examine how debt affects us emotionally, influencing how we behave and how it makes us feel about ourselves.

If you know how and can use money effectively, having the right kinds of debt is usually much better than having no money. A credit score is a number calculated based on your credit history. This number helps lenders identify how much risk they may be taking in lending you money. Find 21 different ways to say BE IN DEBT, along with antonyms, related words, and example sentences at 234000.site debts, but it can make it more difficult. Research shows that 50% of adults who are struggling with debt, also have a mental health issue. Being in debt can be. People with debt are more likely to face common mental health issues, such as prolonged stress, depression, and anxiety. Asking for help can be hard. Are debts causing you stress? Do you feel you never have the time? Whatever the barrier, let's deal with it together. Priority debts are ones where serious action can be taken against you if you don't pay what you owe. For example, you could lose your home, be disconnected from. Living with debt may be seen as “normal” these days, but the damage debt does to our lives is far from okay. After all, carrying too much debt can cause. This helps to pay down debt faster, save on interest expense and may improve your credit score. Know your limits. Being close to or maxing out your credit. When you owe money on your credit card, the people you owe must follow rules set out by law. Action can be taken against you to collect the debt but you have. First things first: Make a list of all your outstanding debts. Include the interest rate on each so you'll be able to determine which ones are causing you the. Strictly speaking, a debt is something (usually money) that has to be repaid to the person/organisation that loaned it to you in the first place, normally with. Funding Programs & Services. The federal government needs to borrow money to pay its bills when its ongoing spending activities and investments cannot be funded. As a general rule, don't borrow more money than you can handle. Borrowing money is a lot easier than paying it back. Smart borrowing can be convenient and. The collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. Pay off the debt. Some collectors will. The benefit of this method is that you'll pay off your smallest balances more quickly, which can be motivating and act as a springboard toward paying off more. People with mental health problems are also more likely to be in problem debt How does being in financial difficulty affect your mental health? "A national debt, if it is not excessive," Hamilton argued, "will be to us a national blessing." The Funding Act. Hamilton, estimating the total public. Debt can be a scary thing, but you can avoid it by following this simple list of best practices like having an emergency fund and tracking your expenses. Living with debt may be seen as “normal” these days, but the damage debt does to our lives is far from okay. After all, carrying too much debt can cause.

1 2 3 4 5