234000.site Overview

Overview

Credit Card Loan Balance Transfer

.jpg?1637650346)

Transfer your credit card balance to a new or existing Prospera credit card and enjoy a 0% interest rate for 9 months. To avoid paying interest on your debt, you open a balance transfer credit card, which comes with 20 months at 0% and a one-off fee of 3% of the amount. Save money when you transfer your balance from a high-interest credit card to a BMO credit card with a balance transfer promotional interest rate. Visa Balance Transfer is Now Just a Few Clicks Away · Click on "Transfer" · Set your Visa Card as the "From Account." · Choose the destination by selecting the. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. You might also lower your overall. Consolidating debt using a credit card balance transfer allows you to find relief from credit card debt without assistance or damage to your credit score. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. · Many balance. A balance transfer is an advance of credit from your MBNA credit card. Requesting a balance transfers can be a convenient way for you to manage your finances. Transfer your credit card balance to a new or existing Prospera credit card and enjoy a 0% interest rate for 9 months. To avoid paying interest on your debt, you open a balance transfer credit card, which comes with 20 months at 0% and a one-off fee of 3% of the amount. Save money when you transfer your balance from a high-interest credit card to a BMO credit card with a balance transfer promotional interest rate. Visa Balance Transfer is Now Just a Few Clicks Away · Click on "Transfer" · Set your Visa Card as the "From Account." · Choose the destination by selecting the. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. You might also lower your overall. Consolidating debt using a credit card balance transfer allows you to find relief from credit card debt without assistance or damage to your credit score. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. · Many balance. A balance transfer is an advance of credit from your MBNA credit card. Requesting a balance transfers can be a convenient way for you to manage your finances.

A balance transfer could consolidate multiple debts into a single monthly payment. icon. Paying off debt faster. Owing less interest on your balances could. A balance transfer credit card can be a powerful tool in your debt-busting arsenal. A 0% introductory APR offer on a credit card can save money by having. It's essentially transferring your credit card debt to another card with zero percent (or low) rates that allow you to whittle down the debt without paying. 13 Best balance transfer cards of September · + Show Summary · Wells Fargo Reflect® Card · Blue Cash Everyday® Card from American Express · Discover. Here's our list of the best balance transfer & 0% APR credit cards, perfect If you've been carrying debt on your credit card that you can't seem to pay off. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Once you take advantage of this balance transfer, you will pay interest on all purchases made with your credit card unless you pay your entire balance . Move your debt to a balance transfer card that offers no interest for up to 20 months, you can save a large chunk of money and pay off your credit card faster. Kotak Mahindra Bank offers competitive interest rates for personal loan balance transfers, making it an attractive option. By transferring your. Credit card balance transfers allow you to move debt from an existing credit card account to a new card at a lower interest rate. Specially designed balance. Move debt from one of your credit cards at another financial institution to your TD credit card. Learn more about our balance transfer credit card options. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. What is a balance transfer credit card? Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low. Reasons to transfer a balance · Lower your interest rate · Consolidate debt from higher-rate loans and/or credit cards · Pay off debt faster · Switch to an account. If you carry multiple loan or credit card balances, a balance transfer credit card may be a good option for consolidating debt and simplifying your. A balance transfer can help save you money by moving your debt to a card with a lower APR. See our picks for best balance transfer credit cards. A balance transfer can help consolidate credit card debt and lower your interest rate. Learn about balance transfers with Navy Federal Credit Union. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a card. A balance transfer involves moving the debt from one or more credit card accounts to a different credit card. This way, you can focus on what you still owe. New Cardholders: 0% introductory APR for 12 months on purchases completed in the first 12 months and balance transfers completed within the first 90 days of.

Best Small Company Credit Cards

TD Business Credit Cards ; TD Business Travel Visa* Card · $ · % · % · Secure ; TD® Aeroplan® Visa* Business Card · $ · % · % ; TD Business Cash. Small Business Credit Cards Compare business credit cards with no annual fee. Choose a KeyBank business credit card that lets you earn cash back, rewards. The right business credit card can help you book travel and earn rewards for your spending. Compare the top business cards today. Business Advantage Unlimited Cash Rewards Mastercard Secured credit card · Help strengthen your business credit while earning unlimited cash back · Business. Business Everyday Points® Credit Card · Earn $ when you spend $5, in the first 90 days · Thereafter, earn unlimited % in rewards on your everyday. Ink Business Preferred® Credit Card: Best for bonus earning · Capital One Venture X Business: Best for businesses with high-spending · The Business Platinum Card®. Best Overall Business Credit Cards · Capital One Spark Cash Plus · Ink Business Cash® Credit Card · The American Express Blue Business Cash™ Card · Ink Business. In this in-depth guide, we'll cover all of the essentials to choosing the right business credit card for your business, with insights and advice from our. The Loop Corporate Credit Card is our pick for the overall best credit card for small businesses. With this card, you earn cash back on your purchases and hold. TD Business Credit Cards ; TD Business Travel Visa* Card · $ · % · % · Secure ; TD® Aeroplan® Visa* Business Card · $ · % · % ; TD Business Cash. Small Business Credit Cards Compare business credit cards with no annual fee. Choose a KeyBank business credit card that lets you earn cash back, rewards. The right business credit card can help you book travel and earn rewards for your spending. Compare the top business cards today. Business Advantage Unlimited Cash Rewards Mastercard Secured credit card · Help strengthen your business credit while earning unlimited cash back · Business. Business Everyday Points® Credit Card · Earn $ when you spend $5, in the first 90 days · Thereafter, earn unlimited % in rewards on your everyday. Ink Business Preferred® Credit Card: Best for bonus earning · Capital One Venture X Business: Best for businesses with high-spending · The Business Platinum Card®. Best Overall Business Credit Cards · Capital One Spark Cash Plus · Ink Business Cash® Credit Card · The American Express Blue Business Cash™ Card · Ink Business. In this in-depth guide, we'll cover all of the essentials to choosing the right business credit card for your business, with insights and advice from our. The Loop Corporate Credit Card is our pick for the overall best credit card for small businesses. With this card, you earn cash back on your purchases and hold.

There are so many great reasons to carry a Truist Visa® card. · Earn a rewards boost. · Empower your employees. · Manage cardholder spend. · Contactless payments. The Capital on Tap business credit card is built for small businesses. Get % unlimited cash back with no annual fee to grow your business. Small Business Credit Card Reviews · Stripe Corporate Card · Chase Ink Business Preferred · Capital One Spark Cash Plus · Chase Ink Business Cash · Blue Business. Why we love this card: We love that The Plum Card fills a need unique to small businesses and isn't just a business-branded version of a consumer credit card. Ink Business Preferred® Credit Card: Best for bonus earning · Capital One Venture X Business: Best for businesses with high-spending · The Business Platinum Card®. Business credit cards can help grow and run your small business or a well-established company. Explore business credit card offers from Citi including cash. Visa CreditLine for Small Business ; Purchase Rate: From Prime + % to % ; Annual Fee: $0 ; Additional Card: $0 (maximum of 1 additional card). A business credit is similar to a personal credit card, with the added perk of allowing you to easily pay for any type of business expense, big or small. American Express offers a small business Credit Card to fit. Which one depends on the nature of the business, it's purchasing needs, and the style of rewards. Small business credit cards have features, rewards, and perks that are designed to benefit smaller companies and entrepreneurs. Choose the credit card that best suits your business needs. · Scotiabank Passport® Visa Infinite Business* Card · Scotia Momentum® for business Visa* Card. It depends on what you spend money on and what you value (cash back, free travel, or other perks). Capital One Spark is good for 2% cash back / miles on. Compare Best Business Cards ; Card Overview · $ Annual Fee ; Card Overview · $ Annual Fee. Best small business credit card options include low rates and fees but even so, debt can occur. IgniteSpot assists owners with credit card reconciliation. Business credit cards ; Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® Credit Card · 1 reviews · % ; Earniva® Business Mastercard with. The best credit cards offer low APR and rewards options. We've selected the best small business credit cards to help set you up for success. The Signify Business Cash Card by Wells Fargo is a no annual fee business credit card that lets you earn unlimited 2% cash rewards. Use our small business credit card comparison tool to find the best card for you and your business. See more card comparison information. Small business credit cards offer easy access to credit along with excellent rewards. The top offers come with significant signup bonuses and fraud protection.

Multi Level Marketing Real Estate

A pyramid scheme is an often illegal, unsustainable business model that lures members via a promise of payments or services for enrolling others. Join thousands of businesses worldwide that choose Yardi property management software and services to optimize every aspect of their operations. One of the biggest myths about Keller Williams Realty, is that our profit sharing business model is some sort of multi-level marketing or pyramid scheme model. The compensation plan is simple, straightforward and easy to understand. The real estate mlm opportunity we promote pay its independent marketers (called real. I have worked on numerous web projects including Multi Level Marketing (MLM) Software Solutions, Direct Selling Software Solutions, Real Estate Portals, Web. Multi-level marketing is a direct selling marketing model with a very good potential to expand businesses. It offers entrepreneurial and substantial income. Multilevel marketing (MLM) is a strategy some direct sales companies use to encourage existing distributors to recruit new distributors who are. In the PBO system, networkers are open to world opportunities. A system where you earn commissions from sales, recruitment, bonuses, trips, etc. Businesses that involve selling products to family and friends and recruiting other people to do the same are called multi-level marketing (MLM). A pyramid scheme is an often illegal, unsustainable business model that lures members via a promise of payments or services for enrolling others. Join thousands of businesses worldwide that choose Yardi property management software and services to optimize every aspect of their operations. One of the biggest myths about Keller Williams Realty, is that our profit sharing business model is some sort of multi-level marketing or pyramid scheme model. The compensation plan is simple, straightforward and easy to understand. The real estate mlm opportunity we promote pay its independent marketers (called real. I have worked on numerous web projects including Multi Level Marketing (MLM) Software Solutions, Direct Selling Software Solutions, Real Estate Portals, Web. Multi-level marketing is a direct selling marketing model with a very good potential to expand businesses. It offers entrepreneurial and substantial income. Multilevel marketing (MLM) is a strategy some direct sales companies use to encourage existing distributors to recruit new distributors who are. In the PBO system, networkers are open to world opportunities. A system where you earn commissions from sales, recruitment, bonuses, trips, etc. Businesses that involve selling products to family and friends and recruiting other people to do the same are called multi-level marketing (MLM).

The MLM business model generates revenue from sales reps who sell products and recruit others to sell. They often use predatory, cult-like tactics that target. Now, if you have understood how the Keller Williams Profit Share system works, you might think that it is somewhat similar to the infamous "Pyramid Scheme" or ". MLM is a direct selling model where distributors sell a company's products or services and earn commissions on their sales. They can also build a team of. Multi-Level Marketing (MLM) Retirement Program the (k). by | | k, Real Estate, Self Directed IRA. An error occurred. Investopedia defines multi-level marketing as “a strategy some direct sales companies use to encourage existing distributors to recruit new distributors who are. Compass came into being thanks to the efforts of its founders, Robert Reffkin and Ori Allon, who started the broker in an effort to impact the real estate. — MLM marketing, associated with InteleTravel; Plexus — health, wellness Property World Africa Network (based in Africa) — real estate; Prosperity of. The introduction of network marketing into real estate was started by Real Estate developers and firms who are involved in developing large. The multi-level marketing (MLM) industry has multiple opportunities for anyone wanting to create and grow their own businesses. The hurtle is, that the. Our software is equipped with a diverse set of features specifically crafted to facilitate the training and growth of agents in the real estate domain. Minds. The compensation plan is simple, straightforward and easy to understand. The real estate mlm opportunity we promote pay its independent marketers (called real. MLM Software for Real Estate · Setup & Grow Your Real Estate Business using Global MLM Revenue Share Software · Recognized As Best in Industry Rankings. List of 30 Best MLM Software in Real Estate Industry · VentaForce · Infinite MLM · Hybrid MLM · Secure MLM · Epixel MLM Software · FINIX. A legitimate Network Marketing company allows independent contractors (called distributors) the ability to become a marketing agent of the company for a small. Multi-level Marketing · Real Estate and Construction Litigation · White Collar Criminal Defense. Ranked In | Chambers | USA | Magleby Cataxinos. Peggy A. The MLM strategy is also known as network marketing or referral marketing. Multilevel Marketing (MLM) - Image of MLM over several piles of coins. Companies that. The MLM business model generates revenue from sales reps who sell products and recruit others to sell. They often use predatory, cult-like tactics that target. Properties Leasing Sales Owners Tenants Directory Markets Public Record Marketing Center Benchmark. US News Retail leasing activity jumped to its highest. A legitimate multi-level marketing company emphasizes reliable products or services. A pyramid scheme uses products or services to disguise its quest for. Discover how you can launch you won wealth-building enterprise sponsoring others in multi-level marketing. Includes profiles of successful sponsors representing.

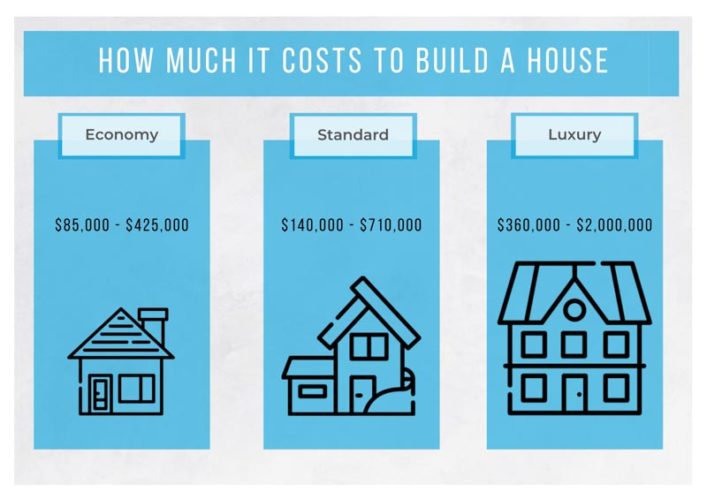

How Much Does It Cost To Build Onto Your House

Do you need a fair, trustworthy, estimate of material and labor costs for a home addition? Just select items from the Project Options list, enter your job. Adding more space to your home will be priced by the square foot. You will usually find costs fall in the range of $ to $ per square foot. The average cost to add a new space is about $ ( 234000.site living room addition on the first floor). Find here detailed information about new space. Generally, it costs less to add a bathroom to your home that fits within its existing footprint. It will cost more to build a new bathroom addition onto your. The average cost for adding a completely new room to your home ranges from $ to $ per square foot. The final price depends on the type of room and the. Many homeowners have unrealistic expectations of the cost of such a project Your design + build firm or contractor should be aware of what the. The average cost to add a bedroom is about $ ( 234000.site master bedroom addition on the first floor). Find here detailed information about bedroom. A common average cost and a good budget to start with is around $, This price assumes a single-story addition. The costs would be significantly higher if. Averagely, a master bedroom addition costs about $ per square foot. You can expect to pay from $80 – $ per square foot, based on your material choice. Do you need a fair, trustworthy, estimate of material and labor costs for a home addition? Just select items from the Project Options list, enter your job. Adding more space to your home will be priced by the square foot. You will usually find costs fall in the range of $ to $ per square foot. The average cost to add a new space is about $ ( 234000.site living room addition on the first floor). Find here detailed information about new space. Generally, it costs less to add a bathroom to your home that fits within its existing footprint. It will cost more to build a new bathroom addition onto your. The average cost for adding a completely new room to your home ranges from $ to $ per square foot. The final price depends on the type of room and the. Many homeowners have unrealistic expectations of the cost of such a project Your design + build firm or contractor should be aware of what the. The average cost to add a bedroom is about $ ( 234000.site master bedroom addition on the first floor). Find here detailed information about bedroom. A common average cost and a good budget to start with is around $, This price assumes a single-story addition. The costs would be significantly higher if. Averagely, a master bedroom addition costs about $ per square foot. You can expect to pay from $80 – $ per square foot, based on your material choice.

The average cost to tear down a house in the United States is $18, The average range is $3,$25,, or $2-$17 per square foot. The cost to demolish a. The costs for this can be in the range of $50, to $,, depending on the size of your house. The floor addition can almost double up your house resale. An addition can be of any size and cost anywhere from $/square foot to $/square foot. No matter how much money you have, there will be. Most home additions cost $80 to $ per square foot, including labor and materials. Larger home additions cost more than smaller ones. If you're adding a. How much does it cost to build your own house? If I have an empty lot of around sq. ft., what will be the approximate cost to build a house. To give you a very rough idea on construction costs you could expect to pay anywhere from $$ per square foot of “finished” space. That's a big spread on. The average permit costs $ and in regard to plans, depending on their complexity and if they're done by a technologist, the cost can range anywhere from. Reload this Page Adding an addition onto your house (how much, construction, contractor). Old , AM. Londonlawyer Londonlawyer started this. $$ per 234000.site $89,$, Other considerations and costs. These are average estimates based on various sizes of loft additions with mid-range. If you're looking to add an extra bedroom or den to your home, this could add $35, to the average price of building a home. However, if you require special. The website also lists a national average for home addition costs of $46, That means that the national average cost for home additions in general is far. For a master suite addition, you will pay $25, to $, or $62, on average. Adding a bedroom and bathroom to your home typically falls in the. average cost per square foot of recently-sold homes. Use that as a rough Does your home addition go with the rest of the house? Making the home. The cost per square foot average was $ per sq ft. If we plot the costs, a couple trends appear, and an important development principle of housing makes. How Much Should You Spend on New Construction Upgrades? For homes up to $,, we usually see 10 - 20% of spending for enhancements like fixtures, flooring. This is one of those cases in which the average doesn't really tell you much. Depending on the type of room addition you're planning, it might cost $ (for a. According to 234000.site, as of , the average cost is R10 to R20 per square meter. Here's a more detailed breakdown by area from Stats SA. How much does it actually cost to add a bathroom to your house? Not considering the cost you'll recoup, the upfront investment can run anywhere from $3, if. Opting for a custom build or a semi-custom build doesn't have to break your budget. So, on average, how much is it to build a house? According to the National. Building out could be a great option for more square footage if you live on a larger property. Smaller yards, though, will limit the size of your build.

Jumbo Personal Loans

A jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a standard mortgage. Today's. Jumbo Loan Benefits · Flexible terms: Jumbo loans generally have flexible terms for how much money you can borrow and what types of properties you can finance. A mortgage is generally considered a Jumbo Loan when it exceeds the conforming loan limit, $, in most U.S counties, set by Fannie Mae and Freddie Mac. Benefits of a Jumbo Loan: · ✓ Loans up to $1,, · ✓ Flexible loan options including fixed and variable terms · ✓ Available for a new home purchase or. A Jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a conventional loan. Jumbo loans. A jumbo loan is a mortgage for higher loan amounts. Get information about jumbo mortgages and view loan rates in your area. A jumbo loan is a type of mortgage loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). Jumbo loans are a type of mortgage product designed for higher-priced homes. They're typically reserved for buyers with good credit, steady income, and a good. Key Takeaway: Jumbo loans are a good option for individuals who need to finance a home that exceeds the conventional loan limit. These types of loans offer. A jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a standard mortgage. Today's. Jumbo Loan Benefits · Flexible terms: Jumbo loans generally have flexible terms for how much money you can borrow and what types of properties you can finance. A mortgage is generally considered a Jumbo Loan when it exceeds the conforming loan limit, $, in most U.S counties, set by Fannie Mae and Freddie Mac. Benefits of a Jumbo Loan: · ✓ Loans up to $1,, · ✓ Flexible loan options including fixed and variable terms · ✓ Available for a new home purchase or. A Jumbo loan will typically have a higher interest rate, stricter underwriting rules and require a larger down payment than a conventional loan. Jumbo loans. A jumbo loan is a mortgage for higher loan amounts. Get information about jumbo mortgages and view loan rates in your area. A jumbo loan is a type of mortgage loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). Jumbo loans are a type of mortgage product designed for higher-priced homes. They're typically reserved for buyers with good credit, steady income, and a good. Key Takeaway: Jumbo loans are a good option for individuals who need to finance a home that exceeds the conventional loan limit. These types of loans offer.

Jumbo loans are mortgages for expensive homes that require a loan amount that exceeds conforming loan limits. A jumbo loan is a type of mortgage loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). The Advantis jumbo mortgage offers you the ability to borrow beyond the conforming limit, from $, up to $2,,, so you can still make your dream home. High Loan Amounts: Finance your dream home with jumbo loan amounts up to $ Million · Stability: Lock in a competitive low interest rate at %* APR for the. A jumbo loan is designed to finance high-cost properties or properties in high-priced locations, with a loan value that exceeds the conforming limit. When the amount you want to borrow for a home exceeds the limits set by the Federal Housing Finance Agency (FHFA) you may need a Jumbo Loan 1. Apply now and. A jumbo loan often means jumbo fees or a higher interest rate. While most lenders add jumbo pricing on loans over $,, Whitefish Credit Union's jumbo loans. Our Jumbo Loan Program can be used for the purchase or refinance of your dream home when it is too expensive for conventional conforming loans. With a jumbo loan you can enjoy an increased purchase limit and a competitive rate for higher-priced properties. Prequalify to see how much you might be able to. When you're borrowing or refinancing more than the conventional limits of $,, you'll need our Jumbo Loans. Choose between a low, fixed rate or the popular. Jumbo mortgages are those loans that exceed the home purchase dollar limits set by the government. Up to % financing available with no Private Mortgage. To qualify for a jumbo loan, you need to have a higher credit score than a conventional loan. Lenders use your credit score to see if you're financially. As the name suggests, jumbo loans are home loans that cover above-average amounts for large homes. These home loans can be used for a primary residence. Jumbo mortgages are those loans that exceed the home purchase dollar limits set by the government. Up to % financing available with no Private Mortgage. Jumbo mortgages are for loan amounts so large that they exceed the conforming loan limits. A jumbo loan is the largest personal, residential mortgage you can. Best large personal loans · Best for fast funding: LightStream Personal Loans · Best for a lower credit score: Upstart Personal Loans · Best for applying with a. Jumbo Loan Features · Jumbo Loans are for mortgages over the conventional loan limit · Fixed-rate and adjustable-rate mortgages available · Competitive rates and. If your home financing needs surpass the maximum conforming limit (as set by Fannie Mae and Freddie Mac), talk with us about a Jumbo loan. Our mortgage experts. With a jumbo loan you can enjoy an increased purchase limit and a competitive rate for higher-priced properties. Prequalify to see how much you might be able to. To qualify for a jumbo loan, you need to have a higher credit score than a conventional loan. Lenders use your credit score to see if you're financially.

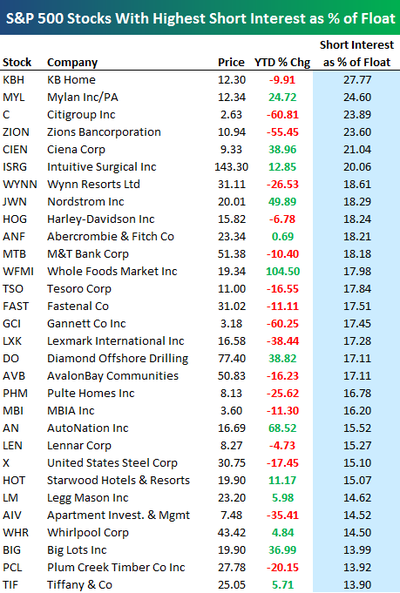

What Stock Shorts The S&P 500

The ETP provides three times the inverse daily performance of the S&P Total Return index, adjusted to reflect fees as well as the costs and revenues. American Airlines (AAL) has the highest short interest by a US stock in the S&P (GSPC), with % of float sold short (M shares). ETFs: ETF Database Realtime Ratings ; SH · ProShares Short S&P, Equity, $1,, % ; SOXS · Direxion Daily Semiconductor Bear 3x Shares, Equity, $ Most Shorted Stocks ; DGLY. Digital Ally, Inc. ; RILY. B. Riley Financial, Inc. ; BYND. Beyond Meat, Inc. ; MPW. Medical. HIU offers investors the inverse (opposite) exposure to the daily performance of the S&P ® Index, providing a strategic tool to potentially profit from. If the S&P index goes up, the fund must pay the daily return to the counterparties from its cash holdings. So the value of the fund will go down when the. Find the latest ProShares Short S&P (SH) stock quote, history, news and other vital information to help you with your stock trading and investing. If the S&P index goes up, the fund must pay the daily return to the counterparties from its cash holdings. So the value of the fund will go down when the. It's nearly impossible to make money shorting the S&P , so here's an alternative trade that's less risky and just as profitable. The ETP provides three times the inverse daily performance of the S&P Total Return index, adjusted to reflect fees as well as the costs and revenues. American Airlines (AAL) has the highest short interest by a US stock in the S&P (GSPC), with % of float sold short (M shares). ETFs: ETF Database Realtime Ratings ; SH · ProShares Short S&P, Equity, $1,, % ; SOXS · Direxion Daily Semiconductor Bear 3x Shares, Equity, $ Most Shorted Stocks ; DGLY. Digital Ally, Inc. ; RILY. B. Riley Financial, Inc. ; BYND. Beyond Meat, Inc. ; MPW. Medical. HIU offers investors the inverse (opposite) exposure to the daily performance of the S&P ® Index, providing a strategic tool to potentially profit from. If the S&P index goes up, the fund must pay the daily return to the counterparties from its cash holdings. So the value of the fund will go down when the. Find the latest ProShares Short S&P (SH) stock quote, history, news and other vital information to help you with your stock trading and investing. If the S&P index goes up, the fund must pay the daily return to the counterparties from its cash holdings. So the value of the fund will go down when the. It's nearly impossible to make money shorting the S&P , so here's an alternative trade that's less risky and just as profitable.

You can short the S&P by shorting shares of a fund that tracks it (like SPY or VOO), buying puts in a fund that tracks it, or shorting index. The ProShares UltraPro Short S&P (SPXU) is a leveraged inverse exchange-traded fund (ETF) that aims to earn three times the inverse of the daily. Page 1 2 3 4 5 6 next». Percentage of shares short calculated based on shares outstanding information and third party short interest Forgotten S&P Giants. In , short sellers targeted troubled companies such as Bed, Bath & Beyond (BBBY) and Carvana (CVNA). In early , the most heavily shorted companies. About ProShares Short S&P The investment seeks daily investment results that correspond to the inverse (-1x) of the daily performance of the S&P ® Index. WisdomTree S&P 3x Daily Short is a fully collateralised, UCITS eligible Exchange-Traded Product. The ETP provides three times the daily. Customize the S&P to meet your investment objective. Invest in just the Sector SPDRs are subject to risk similar to those of stocks including those. The Direxion Daily S&P ® Bull and Bear 3X Shares seek daily investment results, before fees and expenses, of %, or % of the inverse (or opposite). SPY - SPDR S&P ETF Trust Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (ARCA). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index equally weights the stocks in the S&P ® Index. This. You could try ProShares Short QQQ (PSQ) and ProShares Short S&P (SH). Both are non-leveraged ETFs. Results ; SRS, UltraShort Real Estate, Sector ; SRTY, UltraPro Short Russell, Broad Market ; SSG, UltraShort Semiconductors, Sector ; SSO, Ultra S&P What is my worst case scenario? Yup it'll continue to erode until eventually it is worth $0. Inverse ETFs are not actually "shorting", they are. Index Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. market. In this scenario, the liquidity provider (LP) would be shorting the inverse S&P fund to you, so they effectively would have long exposure to the S&P Find the latest quotes for ProShares Short S&P (SH) as well as ETF details, charts and news at 234000.site CME S&P Consolidated Combined Total Reportable Short Positions is at a current level of M, N/A from last week and up from M one year ago. The Daily S&P ® High Beta Bull and Bear 3X Shares seek daily investment results, before fees and expenses, of %, or % of the inverse (or opposite). SH | A complete ProShares Short S&P exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. The index is a measure of large-cap U.S. stock market performance. It is a market capitalization-weighted index of U.S. operating companies and real estate.

Lowest Mortgage Fees

A no-closing-cost mortgage allows you to roll your closing costs into your home loan instead of paying them when you finalize your home purchase. 1. Comparison Shop for Mortgage Rates · 2. Improve Your Debt-to-Income Ratio and Organize Your Finances · 3. Establish a Relationship with a Lender · 4. Negotiate. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. We are cash-out experts. We offer low rates on Cash Out Refinances, Second Mortgages & Home Equity Loans. Current Mortgage and Refinance Rates in Florida ; 15 Year Fixed Conv, %, % ; 30 Year Fixed FHA, %, % ; 30 Year Fixed VA, %, % ; 5/1. Sammamish Mortgage can give you a personalized quote for current mortgage rates in Washington State, Oregon, Colorado, Idaho & California. Satisfy your lender's minimum down payment requirement (this may be as low as 3% down for a conventional loan, % for an FHA loan and 0% for a VA loan); Have. Mortgage rates also play an important role in determining closing costs. A lower fixed interest rate leads to lower monthly mortgage payments. However, it may. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United. A no-closing-cost mortgage allows you to roll your closing costs into your home loan instead of paying them when you finalize your home purchase. 1. Comparison Shop for Mortgage Rates · 2. Improve Your Debt-to-Income Ratio and Organize Your Finances · 3. Establish a Relationship with a Lender · 4. Negotiate. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. We are cash-out experts. We offer low rates on Cash Out Refinances, Second Mortgages & Home Equity Loans. Current Mortgage and Refinance Rates in Florida ; 15 Year Fixed Conv, %, % ; 30 Year Fixed FHA, %, % ; 30 Year Fixed VA, %, % ; 5/1. Sammamish Mortgage can give you a personalized quote for current mortgage rates in Washington State, Oregon, Colorado, Idaho & California. Satisfy your lender's minimum down payment requirement (this may be as low as 3% down for a conventional loan, % for an FHA loan and 0% for a VA loan); Have. Mortgage rates also play an important role in determining closing costs. A lower fixed interest rate leads to lower monthly mortgage payments. However, it may. Ally: Best on a budget. · Better: Best for FHA loans. · Bank of America: Best for closing cost assistance. · USAA: Best for low origination fees. · Veterans United.

Current Mortgage and Refinance Rates in Utah As of September 13, , the rates in Utah are % (% APR) for a year fixed rate mortgage and % . Purchase Mortgage Rates ; 30 Year Low Cost Fixed Rate, %, % ; 15 Year Fixed Rate, %, % ; 15 Year Low Cost Fixed Rate, %, % ; 10 Year Fixed. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. Discover how low Owning's current mortgage rates & start your journey to a new home with an online mortgage pre-approval today! Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate. Assuming a two percent margin and a 40 day period until closing, the rate a lender would quote for a 0 +0 loan (no origination fee and no discount points) would. Your prequalification · Our home loans — and low home loan rates — are designed to meet your specific home financing needs · Today's competitive mortgage rates. The lowest average rate for the year, fixed-rate home loan came in at % in July of Also note these are the lowest weekly average rates recorded by. With low-rate Mortgages And Home Equity Loans and fast decisions, Community First makes buying, refinancing—or using the equity in—your Florida home easier. The year fixed-rate mortgage (FRM) averaged percent, the lowest rate in the survey's history which dates back to Other applicable fees/charges, including deed stamps or deed transfer taxes, are not mortgage closing costs and will not be paid by the Bank. If a customer. I got a deal with an employer affiliate for no loan fees and premium service. VA mortgage with navy Federal is probably the lowest available. Current mortgage rates by loan type ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; FHA year fixed. The current average year fixed mortgage rate fell 2 basis points from % to % on Friday, Zillow announced. The year fixed mortgage rate on. No Closing Costs Home Loan ; 15 Years - Refinance, %, %, $,, $1, ; 20 Years - Purchase or Refi, %, %, $,, $1, Benefits: Offers lower interest rates and a down payment requirement as low as 3% with up to 3% down payment assistance available. Low Interest Rate Program. Compare current mortgage interest rates from a comprehensive list of home loan lenders. Find the best mortgage rates for you. loan products, each with their own rates and fees. Some lenders cater to If you're looking specifically for low mortgage interest rates and savings. To put it simply, it's the mortgage rate that saves you the most money once you factor in fees, closing costs, and loan terms. Obviously, interest rates are. The loan with the lowest mortgage rate may not always be the best choice for you. Rates are important, but you should also consider the overall cost of the loan.

Who Offers Refund Anticipation Loans

Who to Contact. Contact the Refund Anticipation Loan Team by phone at () or send your questions via e-mail to [email protected] for additional. loan secured by their tax refund This compensation may affect what and how we communicate Republic Bank or Santa Barbara Tax Products Group offers to you. By filing taxes with H&R Block, receive a same-day tax advance up to $ Save with H&R Block's Refund Advance offering, with no interest & loan fees. (d) The interest rate for a refund anticipation loan shall not exceed (1) sixty per cent per annum for the initial twenty-one days of such loan, and (2) twenty. A tax Refund Anticipation Loan (RAL) is a loan based an expected federal income tax refund. You generally pay fees and interest to obtain a RAL. "Facilitator" means a person who receives or accepts for delivery an application for a refund anticipation loan, delivers a check in payment of refund. Refund Anticipation Loan Online Quick Approval of $ of refund. Loans begin December 23rd. No Hassle, No upfront fees, Secured by Tax Refund. Refund anticipation loan (RAL) is a short-term consumer loan in the United States provided by a third party against an expected tax refund for the duration. Contact the Refund Anticipation Loan Team by phone at () or send your questions via e-mail to [email protected] for additional assistance. Who to Contact. Contact the Refund Anticipation Loan Team by phone at () or send your questions via e-mail to [email protected] for additional. loan secured by their tax refund This compensation may affect what and how we communicate Republic Bank or Santa Barbara Tax Products Group offers to you. By filing taxes with H&R Block, receive a same-day tax advance up to $ Save with H&R Block's Refund Advance offering, with no interest & loan fees. (d) The interest rate for a refund anticipation loan shall not exceed (1) sixty per cent per annum for the initial twenty-one days of such loan, and (2) twenty. A tax Refund Anticipation Loan (RAL) is a loan based an expected federal income tax refund. You generally pay fees and interest to obtain a RAL. "Facilitator" means a person who receives or accepts for delivery an application for a refund anticipation loan, delivers a check in payment of refund. Refund Anticipation Loan Online Quick Approval of $ of refund. Loans begin December 23rd. No Hassle, No upfront fees, Secured by Tax Refund. Refund anticipation loan (RAL) is a short-term consumer loan in the United States provided by a third party against an expected tax refund for the duration. Contact the Refund Anticipation Loan Team by phone at () or send your questions via e-mail to [email protected] for additional assistance.

Business wishing to act as a Refund Anticipation Loan Facilitator must create an account an apply on ALECS. Please turn your browsers auto fill feature off. Our NO-COST Taxpayer Advance Loan 1 options get high marks for their cost efficiency and convenience. Here's a handy tool for you to use in your office. (4) "Refund anticipation loan" means a loan borrowed by a taxpayer based on the taxpayer's anticipated federal income tax refund. (5) "Refund anticipation loan. And if you are looking for tax refund loan alternatives, Advance America offers a variety of online loans that can get you cash fast. Learn more about what a. A Refund Anticipation Loan (RAL) is a loan made by a lender that is based on and usually repaid by an anticipated federal income tax refund. An Easy Advance is a loan offered to taxpayers that file their taxes electronically with an ERO that uses Republic Bank for their Refund Transfers. Farrington says tax anticipation loans are generally geared toward taxpayers who are eligible for the earned income tax credit or the additional child tax. The “refund” in this situation was a loan from a bank that was repaid when the IRS sent the taxpayer's refund check. The fees charged for the RAL were up-front. Provided by First Century Bank, N.A. Member FDIC, the loan will be equal to a portion of your anticipated refund in one of ten amounts: $, $, $, $1, Blagojevich alerts Illinoisans about the risks of tax refund anticipation loans offers that come with excessively high interest rates and urge. Worried about tax refund delays? If approved, you could access money without waiting for your refund with a no interest Refund Advance loan at H&R Block. When you apply for a refund anticipation loan you are pledging YOUR actual tax refund as collateral for the tax loan advance. You do not have to apply for a tax. When you apply for a RAL, your tax preparer will have you fill out an application for the loan. If your application is approved, you will get a check from the. You can get your refund in 8 to 15 days without paying any extra fees and taking out a refund anticipation loan. You can have your tax return filed. The removal of the debt indicator thus provides an opportunity to estimate a “tax The Effects of Refund Anticipation Loans on Tax Filing and EITC Takeup. Many tax preparers offer a refund anticipation loan (RAL) if you want your refund right away. The tax preparer will give you your refund within a day or two of. "Refund anticipation loan" means a loan that is secured by or that the creditor arranges to be repaid directly from the proceeds of the consumer's income tax. A tax refund anticipation loan is loan offered by a private third party financial services company to individuals that can prove that they are due a tax refund. “Refund anticipation loan” means a loan offered or made to a customer by a lender or through a facilitator based on the customer's anticipated federal income. Find a tax professional that offers Fast Cash Advance Fast Cash Advance is an optional tax-refund related loan provided by First Century Bank, N.A., member.

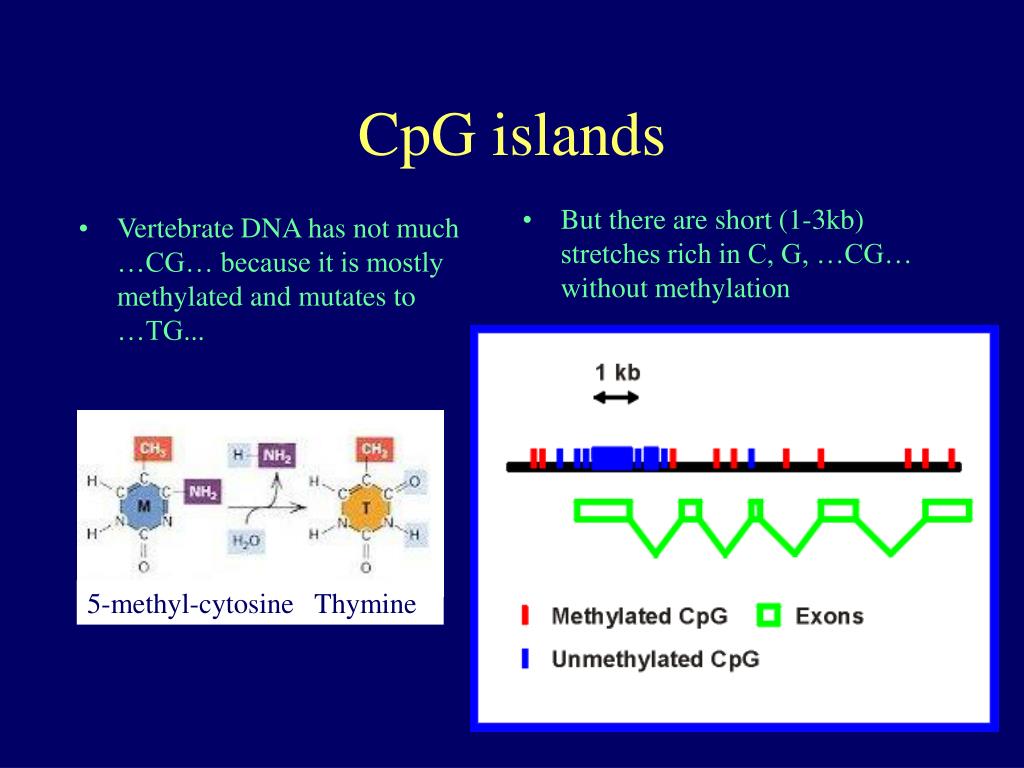

What Is Cpg

CPGs are defined as physical products that consumers buy on a routine basis. Consumer packaged goods (CPG) are items bought for individual use. Consumer goods. Consumer Packaged Goods (CPG) Industry Prospective: The global consumer packaged goods (CPG) market size was worth around USD billion in and is. A consumer packaged goods (CPGs) brand is a business that sells products that consumers need to regularly replace, such as food, clothing, or hygiene essentials. Leading CPG and Retail companies are leveraging digital solutions to deliver innovation from concept to consumer with extraordinary speed. CpG site Not to be confused with CpG oligodeoxynucleotide. The CpG sites or CG sites are regions of DNA where a cytosine nucleotide is followed by a guanine. CPG (Consumer packaged goods) marketing: CPG marketing involves the promotion and sale of everyday products like food, beverages, and household items. It. What Are Consumer Packaged Goods or CPG? Consumer packaged goods, or CPG, refers to the space within an industry that features goods that consumers use in. Consumer Packaged Goods (CPG) are products that consumers use up and replace on a frequent basis. Characterized by their short shelf life, these goods are. As a general rule, FMCG refers to products that consumers use (almost) every day. Like products termed CPG, FMCG products are regular purchases. However, you. CPGs are defined as physical products that consumers buy on a routine basis. Consumer packaged goods (CPG) are items bought for individual use. Consumer goods. Consumer Packaged Goods (CPG) Industry Prospective: The global consumer packaged goods (CPG) market size was worth around USD billion in and is. A consumer packaged goods (CPGs) brand is a business that sells products that consumers need to regularly replace, such as food, clothing, or hygiene essentials. Leading CPG and Retail companies are leveraging digital solutions to deliver innovation from concept to consumer with extraordinary speed. CpG site Not to be confused with CpG oligodeoxynucleotide. The CpG sites or CG sites are regions of DNA where a cytosine nucleotide is followed by a guanine. CPG (Consumer packaged goods) marketing: CPG marketing involves the promotion and sale of everyday products like food, beverages, and household items. It. What Are Consumer Packaged Goods or CPG? Consumer packaged goods, or CPG, refers to the space within an industry that features goods that consumers use in. Consumer Packaged Goods (CPG) are products that consumers use up and replace on a frequent basis. Characterized by their short shelf life, these goods are. As a general rule, FMCG refers to products that consumers use (almost) every day. Like products termed CPG, FMCG products are regular purchases. However, you.

Consumer packaged goods are the products purchased by customers that need regular replacement or repurchases. Examples of CPG include food items. To help you navigate this fast-moving industry, we've created the ultimate guide to CPG jargon. It can be a confusing industry. What is Consumer Packaged Goods (CPG). Chapter 8. Handbook of Research on Strategic Retailing of Private Label Products in a Recovering Economy. A type of good. What is CPG Marketing? CPG marketing, short for Consumer Packaged Goods marketing, is the dynamic engine that powers the promotion and sales of products we. Consumer packaged goods, or CPG, refers to the space within an industry that features goods that consumers use in everyday life. These goods are produced on. Engineers within the Consumer Packaged Goods (CPG) space are problem solvers. They apply engineering methodology to non-traditional engineering problems. Consumer Packaged Goods (CPG) represent a vast category of products that consumers use daily. These items, ranging from food and beverages to personal care and. Consumer Packaged Goods or CPG are goods that are consumed and replaced regularly by customers. Read to know more about CPG and how do they work! Consumer packaged goods (CPGs) are everyday items that people regularly buy for personal or domestic use. Consumer packaged goods marketing (CPG marketing) refers to the sales and consumer engagement tactics a brand uses to sell items that customers regularly. CPG marketing is a specific advertising strategy for consumer packaged goods (CPG) companies. CPG goods are perishable goods that consumers regularly. In this article, we will take a deep dive into CPG marketing and present you with key strategies that can set you apart from the crowd. Consumer Packaged Goods (CPG) are products that consumers use up and replace on a frequent basis. Characterized by their short shelf life, these goods are. Today, the consumer-packaged goods industry is one of the largest sectors. Consumer packaged goods have a short shelf life and are always in high demand. These. CPG brands should not feel an obligation to avoid competing with its own direct-to-consumer (DTC) websites or subscription models. Consumer-packaged goods (CPGs) are everyday goods like packaged food and cleaning supplies that require regular replenishment. CPG is the acronym for Consumer Packaged Goods. What is Consumer Packaged Goods? These are products that are sold quickly and at a relatively low cost. Elevate your CPG digital marketing with Adobe for Business. Real-time data, streamlined content & personalized customer journeys in one platform. A Career in CPG Industry has high growth potential. The room for innovation and cross learning is high with CPG company. Within CPG, what skill. Consumer Packaged Goods (CPG) are products that are consumed on a daily basis by individuals and are usually sold in packaging designed for mass consumption.

How To Find Out Who A Person Is Texting

Can I resend an eGift if it gets deleted or lost by the person I sent it to? I don't see my past messages on my new Samsung phone. How do I transfer my. Recognise the signs someone is trying to scam you, and learn how to check if a message you have received is genuine. Recognising online scams. Cyber criminals. Find out whom they texted. Are they sending texts to numbers you don't recognize? Find out with a birds-eye-view of their SMS activity. Call Tracker feature. Texting In. In crisis? Here's everything you need to know about reaching a Crisis Counselor to help you from that hot moment to totally cool and calm. Someone may be lying if they take a while to respond, over-explain, or are even suddenly sweet to you. Text Free - Free Text to any number in the USA Canada: free text / SMS plus MMS plus group chat! Free Calling App - Free Call to any number in the USA. There is a way to find out if someone has read your text message, and it is called, “read receipts”. A healthy way to let your partner know this is simply by telling them. It is a lot easier to ignore a text and forget about it than to ignore someone in person. If the person who you sent a message to has their read receipts enabled, then they will automatically send a read receipt when they open the message. Some. Can I resend an eGift if it gets deleted or lost by the person I sent it to? I don't see my past messages on my new Samsung phone. How do I transfer my. Recognise the signs someone is trying to scam you, and learn how to check if a message you have received is genuine. Recognising online scams. Cyber criminals. Find out whom they texted. Are they sending texts to numbers you don't recognize? Find out with a birds-eye-view of their SMS activity. Call Tracker feature. Texting In. In crisis? Here's everything you need to know about reaching a Crisis Counselor to help you from that hot moment to totally cool and calm. Someone may be lying if they take a while to respond, over-explain, or are even suddenly sweet to you. Text Free - Free Text to any number in the USA Canada: free text / SMS plus MMS plus group chat! Free Calling App - Free Call to any number in the USA. There is a way to find out if someone has read your text message, and it is called, “read receipts”. A healthy way to let your partner know this is simply by telling them. It is a lot easier to ignore a text and forget about it than to ignore someone in person. If the person who you sent a message to has their read receipts enabled, then they will automatically send a read receipt when they open the message. Some.

A person could carry out () went further, observing hundreds of academic papers from previous undergraduate students' exams, only to find that out of. Find out how to send & receive text messages on your Samsung Galaxy phone If you want to send a message to someone who is not a contact you can. I Caught My Wife Texting Another Man. person holding black android smartphone. Share · Tweet · Pin Can you throw your phones on the table and say check out. It is important to know the international SMS options available to you. This guide offers info on: International chatting apps; Web-based online messaging. Someone may be lying if they take a while to respond, over-explain, or are even suddenly sweet to you. I'm not sure if I need help. Find out what to do. I'm worried about someone else. Find out how to help them. About Find out more about Suicide. Now that you know you've been blocked, let's move on to the next topic. Get Virtual Phone Number to Send Text Messages. Get affordable virtual phone numbers to. Out filter available on the Person Base that allows you to identify records with a mobile phone number that is currently opted-out of receiving text messages. We're also providing action steps based on this data to create better customer experiences and drive revenue. Sound good? We know you're going to skim this, so. Find out how to send and receive texts with your mobile device and ways to archive your messages. Learn how to fix text messaging problems by restarting or. The answer is Read Receipts. Read receipts is the most popular technology for pinpointing when someone has read your SMS. “I like that I can easily set up campaigns on Hustle and know who sent what when.” Read their story. Truecaller is among the best in the business. How to keep customers from blocking your texts. Obviously, it's nice to know how to block texts you don't want to. And while you might be curious to know who is sending you these messages, resist the urge to engage with them to find out. Related: Can Someone Hack Your. > Privacy > Phone Number > Who can find me by my number. This setting determines whether someone is able to see that they can message you on Signal by searching. If you have a cell phone, you probably use it dozens of times a day to text people you know. Picture this, your phone buzzes and you see a notification, It's a text from your friend. Your friend typed it out, hit send and it landed in your inbox. Since. Discover Galaxy phones with the pre-installed Samsung Messages app on our website. To see what other opt-out of targeted ads options are available to you. Unexpected contact. Think about how an organization usually contacts you. If it isn't via a text message, contact them directly to check if it's legitimate. Easily connect with your audience where they hang out most—on their phones. Put the right message in front of the right person at the right time. See higher.

1 2 3 4